What Does Clark Wealth Partners Mean?

Table of ContentsTop Guidelines Of Clark Wealth PartnersClark Wealth Partners Can Be Fun For AnyoneMore About Clark Wealth PartnersThe Only Guide to Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisThe Best Guide To Clark Wealth PartnersEverything about Clark Wealth Partners

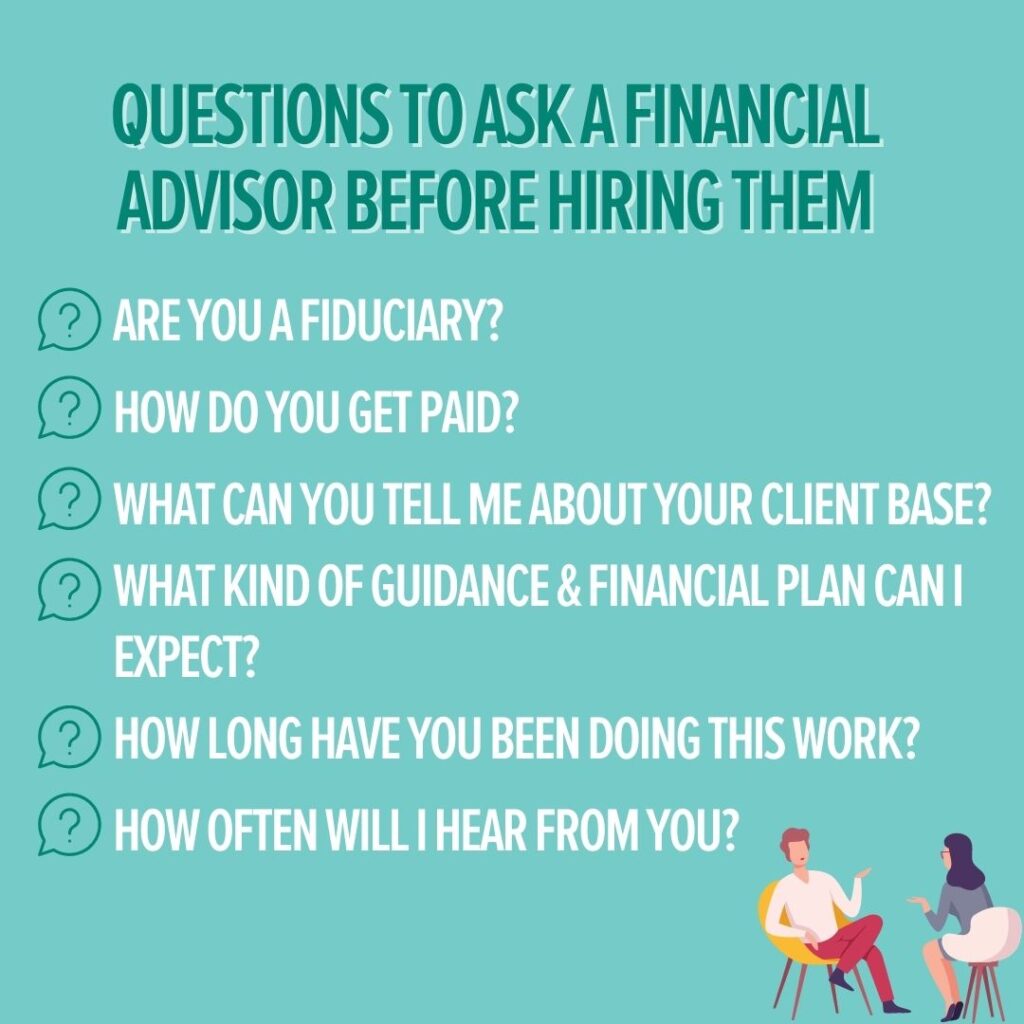

These are experts who give financial investment advice and are signed up with the SEC or their state's safeties regulator. Financial experts can likewise specialize, such as in pupil fundings, elderly requirements, tax obligations, insurance policy and various other elements of your finances.Just monetary consultants whose designation requires a fiduciary dutylike licensed economic coordinators, for instancecan state the same. This difference also indicates that fiduciary and economic expert fee frameworks vary as well.

The Facts About Clark Wealth Partners Uncovered

If they are fee-only, they're much more most likely to be a fiduciary. If they're commission-only or fee-based (suggesting they're paid by means of a mix of charges and commissions), they could not be. Numerous qualifications and classifications need a fiduciary obligation. You can examine to see if the professional is signed up with the SEC.

:max_bytes(150000):strip_icc()/financialplanner.asp-FINAL-1-55c5c0b665934b9d96cfe8af04fef3a3.png)

Choosing a fiduciary will guarantee you aren't guided towards specific investments because of the payment they provide - financial planner in ofallon illinois. With great deals of money on the line, you may want an economic professional that is lawfully bound to make use of those funds thoroughly and only in your ideal passions. Non-fiduciaries might recommend financial investment products that are best for their wallets and not your investing objectives

Not known Facts About Clark Wealth Partners

Find out more now on how to keep your life and financial savings in equilibrium. Boost in cost savings the average house saw that functioned with a financial consultant for 15 years or more compared to a similar family without an economic consultant. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "Much more on the Value of Financial Advisors," CIRANO Project Information 2020rp-04, CIRANO.

Financial suggestions can be helpful at transforming points in your life. Like when you're beginning a family, being retrenched, planning for retired life or managing an inheritance. When you consult with a consultant for the very first time, function out what you want to obtain from the suggestions. Before they make any type of referrals, a consultant must make the effort to discuss what's vital to you.

7 Easy Facts About Clark Wealth Partners Explained

When you have actually accepted proceed, your financial adviser will prepare a monetary prepare for you. This is provided to you at another meeting in a record called a Statement of Guidance (SOA). Ask the consultant to explain anything you don't recognize. You should constantly feel comfy with your consultant and their suggestions.

Insist that you are informed of all transactions, and that you get all communication pertaining to the account. Your advisor might recommend a handled optional account (MDA) as a way of handling your investments. This includes signing a contract (MDA agreement) so they can acquire or offer investments without needing to check with you.

What Does Clark Wealth Partners Do?

To shield your money: Do not give your advisor power of lawyer. Firmly insist all correspondence about your investments are sent to you, not simply your consultant.

This might occur throughout the meeting or electronically. When you go learn this here now into or renew the continuous cost arrangement with your advisor, they need to describe how to end your partnership with them. If you're relocating to a new advisor, you'll require to set up to transfer your economic documents to them. If you require assistance, ask your adviser to describe the procedure.

To load their shoes, the nation will certainly require more than 100,000 new financial experts to go into the market.

Unknown Facts About Clark Wealth Partners

Aiding individuals attain their economic goals is a financial consultant's primary function. However they are likewise a small company proprietor, and a part of their time is dedicated to managing their branch workplace. As the leader of their method, Edward Jones economic advisors require the leadership abilities to hire and manage staff, in addition to business acumen to create and perform an organization strategy.

Financial advisors spend a long time every day watching or checking out market news on television, online, or in profession magazines. Financial consultants with Edward Jones have the benefit of home workplace research groups that assist them keep up to day on stock recommendations, shared fund monitoring, and more. Investing is not a "collection it and neglect it" task.

Financial experts must set up time each week to satisfy brand-new people and capture up with the people in their ball. Edward Jones economic experts are lucky the home workplace does the hefty lifting for them.

Some Ideas on Clark Wealth Partners You Need To Know

Proceeding education and learning is a required component of keeping an economic expert certificate (st louis wealth management firms). Edward Jones monetary experts are encouraged to pursue additional training to expand their understanding and skills. Commitment to education protected Edward Jones the No. 17 area on the 2024 Training peak Awards listing by Training publication. It's additionally an excellent idea for monetary advisors to participate in sector meetings.